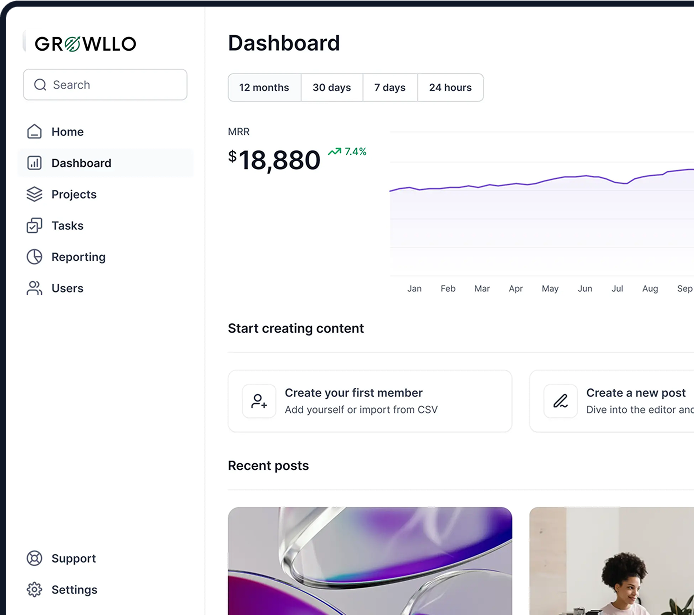

AI Agents

Loan Processing AI Agent

The Loan Processing AI Agent automates the entire loan lifecycle—from application intake to verification, underwriting, and approval. It reduces manual work, minimizes errors, and ensures faster, more accurate loan decisions, giving financial institutions and lenders a competitive edge.

Faster Loan Approvals

0

%

Lower Processing Costs

0

%

Fewer Errors

0

%

Trusted by Banks and Lending Institutions

Financial organizations rely on the Loan Processing AI Agent to speed up loan approvals while maintaining compliance and accuracy. By eliminating bottlenecks and manual reviews, it delivers a seamless experience for both lenders and borrowers.

Automated Application Intake

Captures and organizes borrower details instantly.

Document Verification

Validates ID, income, and financial records with accuracy.

Credit Risk Assessment

Analyzes borrower data to assess eligibility and reduce default risk.

Decision Automation

Speeds up approvals with rule-based and AI-powered underwriting.

Start Smarter Loan Processing Today

Work with GROWLLO to design a Loan Processing AI Agent that accelerates approvals, minimizes risks, and enhances the borrower experience.

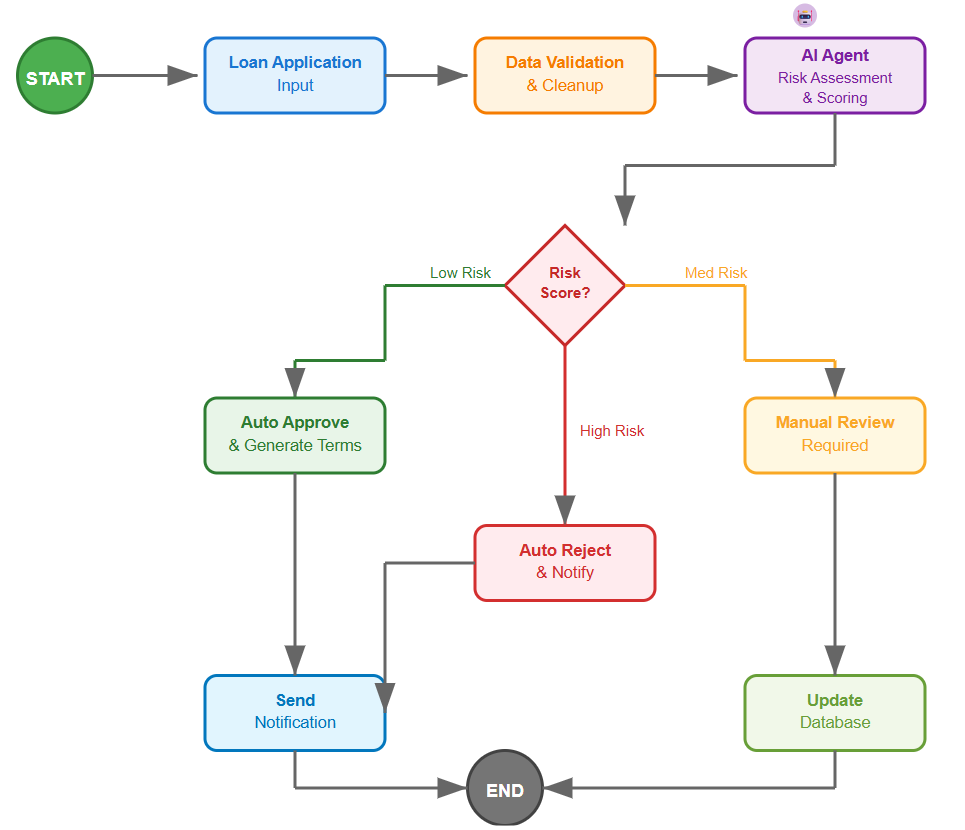

Workflows

Automated Loan Processing

This AI agent verifies applications, analyzes eligibility, detects risks, and streamlines approvals to make loan processing faster, more accurate, and hassle-free.