AI Agents

Suspicious Activity Reporting AI Agent

The Suspicious Activity Reporting (SAR) AI Agent helps financial institutions and businesses identify unusual transactions, flag potential fraud, and generate regulatory-compliant reports automatically. It reduces manual investigation time while ensuring accurate and timely submissions to authorities.

Faster Case Resolution

0

%

Lower Compliance Costs

0

%

Improved Detection Accuracy

0

%

Trusted by Compliance and Risk Teams

Banks, fintechs, and enterprises rely on the Suspicious Activity Reporting AI Agent to meet anti-money laundering (AML) requirements, detect fraudulent activity, and stay ahead of regulatory obligations.

Automated Detection

Identifies unusual transaction patterns in real time.

Regulatory Reporting

Generates and files SARs in line with AML and KYC regulations.

Risk Scoring

Assesses the severity of suspicious activities for prioritized action.

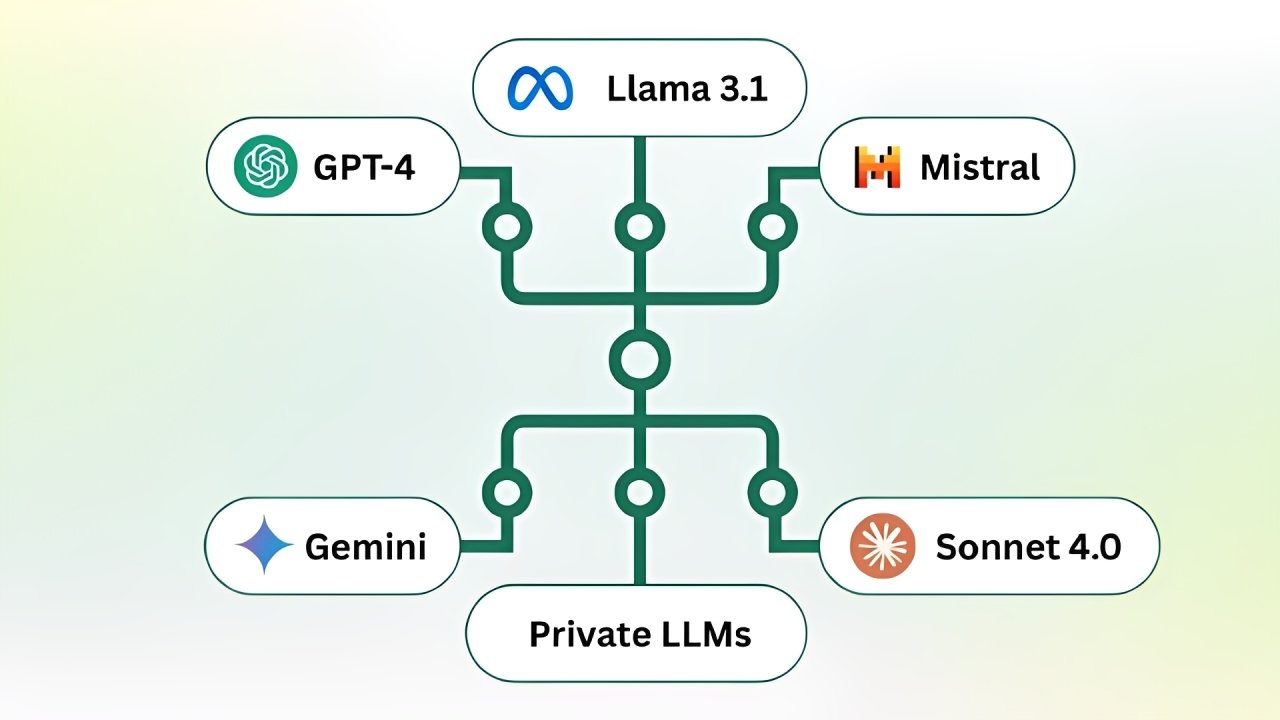

Seamless Integration

Works with core banking, ERP, and compliance monitoring systems.

Start Smarter Compliance Today

Work with GROWLLO to design a Suspicious Activity Reporting AI Agent that enhances fraud detection, ensures compliance, and keeps your organization protected.

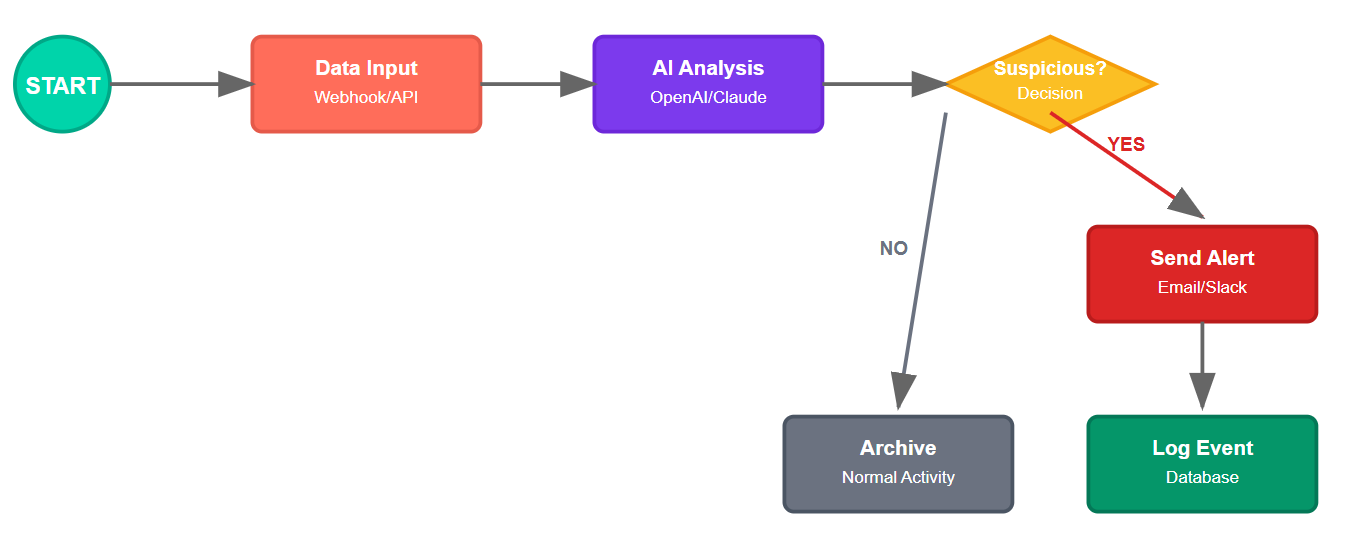

Workflows

Automated Suspicious Activity Reporting

This AI agent monitors transactions, detects unusual patterns, flags high-risk activities, and generates compliance-ready reports to strengthen security and reduce fraud risks.